What Does the End of the CFPB Mean for Credit Risk Innovation?

The Fintech Times

JULY 1, 2025

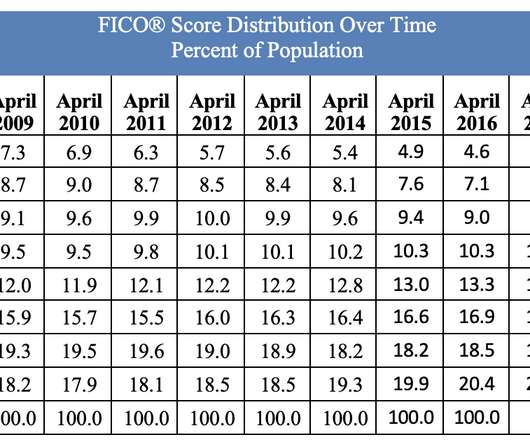

Credit data Average FICO scores rose from 688 in 2011 to 718 in 2023, suggesting that those already in the system were improving their credit profiles. But the people who needed help the most — those outside the traditional credit model — weren’t lifted by that rising tide. appeared first on The Fintech Times.

Let's personalize your content