Finance Teams: Stop Wasting Time on Manual Account Reconciliation & Automate

The Finance Weekly

NOVEMBER 3, 2021

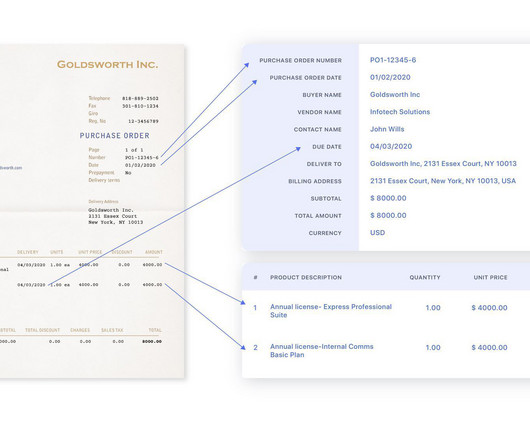

For both internal and external sources, each balance has to match the corresponding account in the general ledger. Inter-company transactions, currency exchange rates and various non-cash activities only complicate things in an already complex, time-consuming process. Adopting Superior Methods in 2021.

Let's personalize your content