AI Becomes the Banker: 21 Case Studies Transforming Digital Banking CX

Finextra

JULY 7, 2025

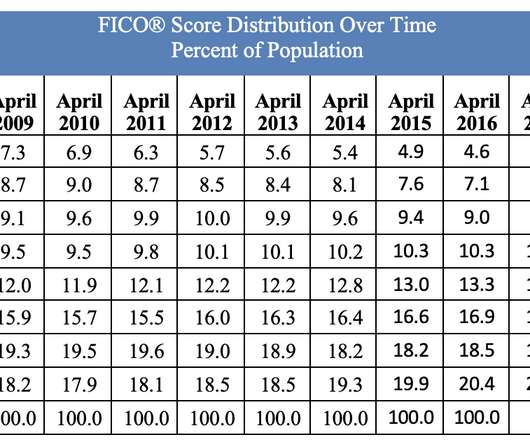

Traditional areas like fraud prevention (65%), credit underwriting (62%) and regulatory compliance (58%) are still heavily prioritized, reflecting that these were some of the first uses of AI in banking and continue to be critical for reducing losses. Upstart’s AI models evaluate credit risk more holistically than FICO scores.

Let's personalize your content