How to Choose Between EFT vs ACH: A Comprehensive Guide

Stax

MARCH 27, 2025

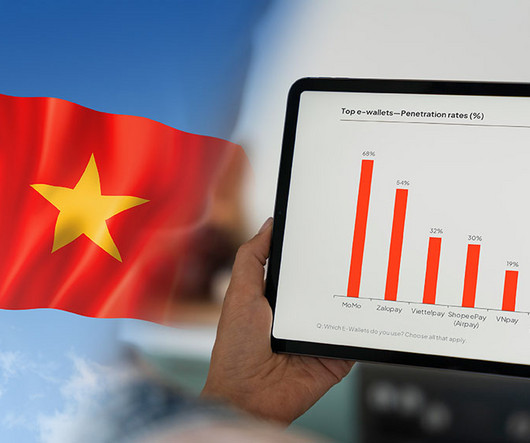

Digital wallets accounted for 50% of eCommerce purchases , while debit cards raked up 12% of total transactions last year. Clients only need to swipe a card at your point-of-sale (POS) terminal or enter their bank account number into your website (Initiation). EFT reduces friction in the customer journey.

Let's personalize your content