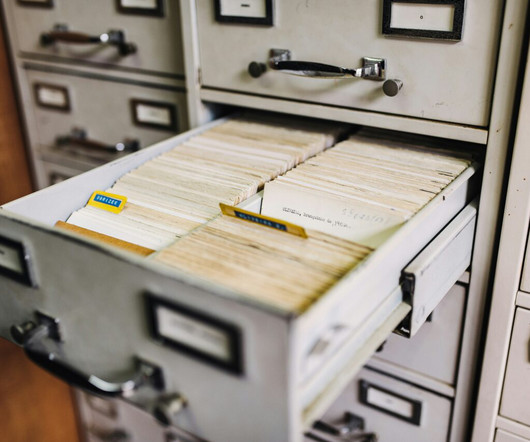

5 Things Banks Should Know about the FDIC’s Recordkeeping Requirements Rule

Finovate

SEPTEMBER 18, 2024

Adding to the confusion, the dispute is ongoing in court, and because Synapse is a fintech and is thus unregulated, regulatory bodies are unable to protect consumers, many of whom are still missing their funds. .” Banks have long been subject to strict regulations and reporting requirements.

Let's personalize your content