Economic Crime and Corporate Transparency Act examined: A guide to avoiding failure-to-prevent fraud measures

The Payments Association

FEBRUARY 10, 2025

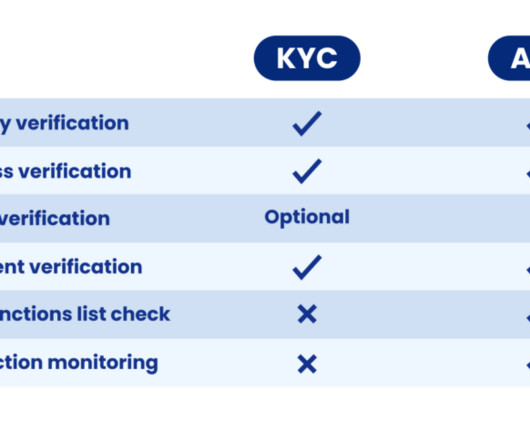

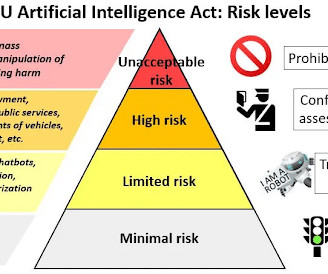

The Home Office outlines six key principles: tone from the top, due diligence, risk assessment, proportionate procedures, monitoring/review, and communication/training. While many firms already implement fraud risk assessments and controls, this may not suffice.

Let's personalize your content