The Full List of Fintech Unicorns in Asia (2025)

Fintech News

APRIL 24, 2025

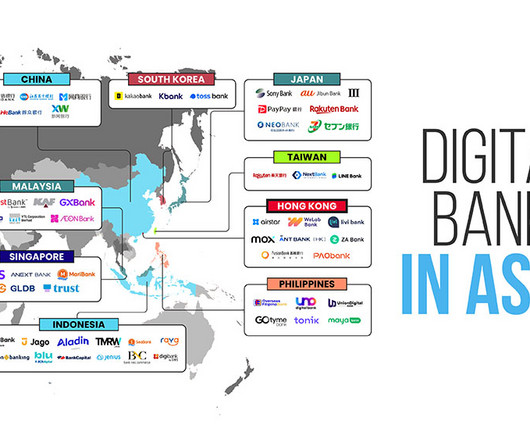

It provides access to game credits, gift codes, and vouchers using familiar local payment methods such as mobile carrier billing and e-wallets. The city is home to four fintech unicorns in Asia: HashKey Group, WeLab, Micro Connect, and ZA Group, each pushing the boundaries of digital finance in unique ways. billion payments Coda 2.5

Let's personalize your content