Young people fall prey to payments fraudsters

Payments Dive

NOVEMBER 12, 2024

Debit and credit card users under 40 years old are more likely than older peers to experience fraud in making payments, a recent J.D. Power survey found.

Payments Dive

NOVEMBER 12, 2024

Debit and credit card users under 40 years old are more likely than older peers to experience fraud in making payments, a recent J.D. Power survey found.

EBizCharge

NOVEMBER 12, 2024

Mastering the financial aspects of operating a business is paramount to achieving success. A fundamental element that every business leader should be well-versed in is the merchant account — a critical service that facilitates electronic payments. As digital payments continue to grow in popularity, a frictionless payment processing system is vital. What is a merchant account?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Basis Theory

NOVEMBER 12, 2024

Historically, data security has been treated as featureless and burdensome—but a necessary expense incurred by organizations. Tokenization, however, has reframed the conversation, leading to an explosion in its usage. Today, we can tokenize anything from credit card primary account numbers (PAN) to one-time debit card transactions or social security numbers.

The Payments Association

NOVEMBER 12, 2024

What is this article about? Whether financial institutions should build or buy financial crime management systems. Why is it important? The choice affects compliance, efficiency, and fraud prevention capabilities. What’s next? Institutions may lean toward hybrid solutions to balance customisation with vendor support. As Financial crime grows increasingly complex, payment leaders face a critical choice: build an in-house financial crime management (FCM) solution or buy an established third-

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

The Fintech Times

NOVEMBER 12, 2024

Turkish customers using financial services provider, Papara , will now be able to send money into three billion mobile wallet accounts, four billion bank accounts and 15 billion cards in over 80 currencies and to more than 130 countries following a new partnership with Thunes , the cross-border payment infrastructure provider. Papara becomes the latest member of Thunes ‘ Direct Global Network as Thunes facilitates cross-border payments to and from Türkiye.

Finovate

NOVEMBER 11, 2024

BNZ has acquired open banking payments company BlinkPay to enhance its focus on real-time, bank-to-bank payment solutions across New Zealand. Financial terms of the acquisition were not disclosed. BlinkPay will maintain its original leadership and culture, with company Co-founder Adrian Smith appointed as CEO. BNZ announced today it has acquired fellow New Zealander BlinkPay , an open banking focused payments company.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Fintech News

NOVEMBER 10, 2024

The payment ecosystem is grappling with a rapidly evolving fraud landscape, characterized by a sharp rise in purchase return authorization (PRA) attacks, increasingly sophisticated ransomware schemes and the growing misuse of artificial intelligence (AI) by cybercriminals, a new report by Visa Payment Fraud Disruption (PFD) says. The State of Scams: Fall 2024 Biannual Threats Report, released end of October, highlights emerging threats and scams targeting the payment ecosystem, emphasizing the h

Stax

NOVEMBER 14, 2024

Credit card processing can be overwhelming, expensive, and confusing. And yet, accepting non-cash forms of payments is more or less required to operate a modern business, at least in the U.S. Credit, debit, and digital payments have far and away become the most popular payment method. Cash has dropped to less than 20% of all US payments in recent years.

Clearly Payments

NOVEMBER 13, 2024

In payment processing, one component of the payment processing tech stack involving credit or debit cards is the Bank Identification Number or BIN. Although BINs play a critical role in how payments are processed and authenticated, they often go unnoticed by the average consumer or merchant. For payment processors and financial institutions, however, understanding BINs is essential for smooth transaction processing, security, and even risk management.

Fintech Finance

NOVEMBER 13, 2024

Blink Payment , a UK paytech platform that offers businesses seamless digital payment solutions, today announces its entry into B2B fashion payments through integration with ERP Zedonk , in a move that will enable more than 1,000 leading fashion brands and showrooms to streamline their buyer payments. Zedonk currently services over 1,000 brands and showrooms across 45 countries, many of whom distribute their products to individual retailers.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Fintech News

NOVEMBER 13, 2024

Cake by VPBank, a Vietnamese digital bank, has collaborated with Visa to launch a cloud-based card management system (CMS). The system, built on Google Cloud infrastructure and using Visa Cloud Connect, integrates with Visa’s global payment network. The CMS aims to enhance payment processing in Vietnam by leveraging cloud infrastructure, allowing for secure and streamlined operations.

Finovate

NOVEMBER 14, 2024

Payfinia has launched a new Credit Union Service Organization (CUSO) to help credit unions modernize their payments experience. The CUSO is launching in partnership with Star One Credit Union, which invested $4.5 million in the organization. Payfinia’s IPX platform will play a key role in the CUSO, helping organizations leverage FedNow to offer instant payments while providing fraud prevention.

The Fintech Times

NOVEMBER 15, 2024

Blink Payment , a UK paytech platform offering digital payment solutions to businesses, plans to enter B2B fashion payments through integration with Zedonk , an Enterprise Resource Planning (ERP) software provider, to help over 1,000 fashion brands and showrooms streamline their payment processes. Blink Payment plans to offer support to brands, serviced by Zedonk, that lack the payment infrastructure enabling them to settle invoices via methods other than bank transfer – which can be slow

Fintech Finance

NOVEMBER 14, 2024

Unlimit , the global fintech company, has today announced its partnership with Pagaloop , a prominent Latin American B2B payments and cash flow management platform. The partnership will focus on strengthening the Pagaloop app’s credit and debit card processing capabilities and ensuring high approval rates to facilitate the company’s continued expansion in the region.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Fintech News

NOVEMBER 12, 2024

Dr. Sethaput Suthiwartnarueput, Governor of the Bank of Thailand , recently addressed the Singapore Fintech Festival, sharing insights on Thailand’s advancements in digital finance. He emphasized the country’s successful implementation of the PromptPay system and QR code standards, which have significantly broadened access to digital payments while prioritizing security.

Finovate

NOVEMBER 15, 2024

Visa’s Flexible Credential card is now available in the U.S. and U.A.E., offering cardholders flexibility to pay from multiple account funding sources. In the U.S., Affirm will integrate VFC into its buy now, pay later (BNPL) Affirm Card, while UAE-based Liv will leverage VFC to enable multi-currency transactions through a single card. The VFC is similar to Curve’s multi-payment card offerings, however, Visa’s VFC requires users to select the payment type before transactions.

The Fintech Times

NOVEMBER 12, 2024

The mastermind behind the accelerator programme Base Camp, Outlier Ventures , the Web3 accelerator, has announced that Bando , Berry Investing , Fact Finance , Loula and IDENTI will be taking part in its Latin America (LatAm) edition. The LatAm Base Camp is an inaugural accelerator programme dedicated to partnering with Web3 startups in Latin America.

Fintech Finance

NOVEMBER 13, 2024

Mastercard today announced its vision to transform online shopping by 2030. Imagine a future where no physical card numbers are needed for purchases. Where passwords or one-time codes are obsolete, and secure on-device biometrics allow seamless authentication across devices and websites, ensuring personal data stays on the device. This vision is already becoming a reality today in major markets and is poised to become ubiquitous within a few short years.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Fintech News

NOVEMBER 12, 2024

SCB 10X, a subsidiary of SCBX Group, has launched Rubie Wallet, a digital wallet specifically designed for international visitors attending Devcon 2024 and related side events in Bangkok. Rubie Wallet marks Thailand’s first implementation of Purpose-Bound Money (PBM), introduced under the regulatory sandbox framework established by the Bank of Thailand (BOT) and the Securities and Exchange Commission (SEC).

Finextra

NOVEMBER 14, 2024

In this PREDICT 2025 interview, Gautam Pillai, Head of Fintech Research at investment bank Peel Hunt, looks at the bigger picture and takes into account how the payments industry is transforming alongside consumer trends. Buzz and excitement surrounds three developments, which are embedded payments, cross border payments and generative AI and the interview discusses how organisations working in these areas are already helping businesses transact easier, faster and in a way where they are not sac

The Fintech Times

NOVEMBER 14, 2024

Miami-based fintech startup enabling Latino workers in the US to send money back to their families in Latin America via WhatsApp , Félix Pago is expanding its services to El Salvador, Honduras, Guatemala, and the Dominican Republic following a new partnership with payments giant, Mastercard. Félix Pago uses blockchain and artificial intelligence (AI) to power its chat-based platform which makes financial services more accessible for those in historically underserved regions.

Fintech Finance

NOVEMBER 14, 2024

Mollie , one of Europe’s fastest-growing financial service providers, today announces its official launch in Italy, marking a significant milestone in its mission to make payments and money management effortless for every business in Europe. The expansion will enable Italian businesses to access a single platform designed to simplify payment processing, reporting and fraud prevention.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

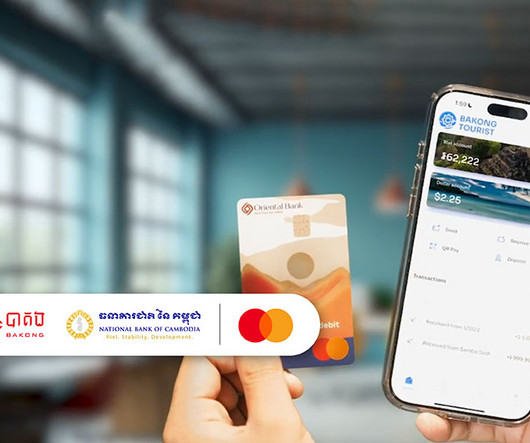

Fintech News

NOVEMBER 11, 2024

The National Bank of Cambodia (NBC) has launched the Bakong Tourists app in collaboration with Mastercard at a ceremony in Phnom Penh. The app simplifies digital payments for international tourists visiting Cambodia. Tourists can download the app upon arrival and seamlessly top up their Bakong accounts using their Mastercard issued in their home countries.

The Payments Association

NOVEMBER 12, 2024

Independent UK law firm Burges Salmon has announced the appointment of partner Martin Cook as the new head of the firm’s significant and fast growing Financial Services sector. In his new role, Martin will play an instrumental part in continuing to grow the firm’s presence in the sector and enhancing its innovative solutions to continue to support clients with every day legal needs, business critical projects and every touchpoint in between.

The Fintech Times

NOVEMBER 14, 2024

The Middle East has traditionally been associated with a reliance on an economic reliance on the region’s rich oil reserves. However, following the Covid pandemic, and various governmental initiatives, many countries focused on diversifying their economies and bolstering growth and innovation across various sectors. However, according to Fuse , a company committed to building a common layer of infrastructure across payments across the Middle East and North Africa (MENA), the region remains

Fintech Finance

NOVEMBER 13, 2024

Citi (NYSE: C) and Bank of Shanghai launched a first-of-its-kind payments solution on Bank of Shanghai ’s TourCard. The TourCard aims to provide international travelers a straightforward, cost-efficient and more streamlined Chinese yuan renminbi (CNY) payment journey while traveling in China. The payment service is facilitated by Citi’s industry-leading USD Clearing solution and its full-value transfers, which ensures the final beneficiary receives their money at full value with no deductions.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Fintech News

NOVEMBER 13, 2024

Payment giant Visa announced its commitment to supporting digital creators by recognising them as small businesses at the Web Summit in Lisbon. This provides creators with access to Visa’s financial tools, resources, and products, including business cards, payment controls, and programmes like Practical Business Skills, previously only available to traditional small businesses.

The Payments Association

NOVEMBER 11, 2024

Open banking, the initiative allowing third-party providers (TPPs) access to customer financial data with explicit consent, promised a revolution in the financial landscape. Initially lauded as a catalyst for innovation and consumer empowerment, its European rollout, while making significant progress, has fallen short of initial expectations. This article delves into the goals, challenges, and future of open banking, focusing specifically on the profitability concerns hindering widespread adopti

The Fintech Times

NOVEMBER 15, 2024

Pagaloop , the Latin American (LatAm) B2B payments and cash flow management platform is strengthening its app’s credit and debit card processing capabilities following a new partnership with global fintech Unlimit. The new collaboration will see Unlimit ensure high approval rates to facilitate Pagaloop’s continued expansion in LatAm. It will use its acquiring network to support Pagaloop payments through all major card schemes, including Visa and Mastercard.

Fintech Finance

NOVEMBER 12, 2024

Today, Visa (V: NYSE) announced that the Flexible Credential is expanding to the U.S. and will be rolling out with Affirm, and in the United Arab Emirates with Liv, giving millions more people greater choice and control over how they pay. “The Visa Flexible Credential all started with a simple idea that consumers should easily be able to choose how they want to pay,” said Jack Forestell, Chief Product and Strategy Officer, Visa.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Let's personalize your content