Commercial Banks Successfully Rebuilt Liquidity to Pre-Crisis Levels, But Challenges Remain Says Q2

The Fintech Times

JANUARY 31, 2025

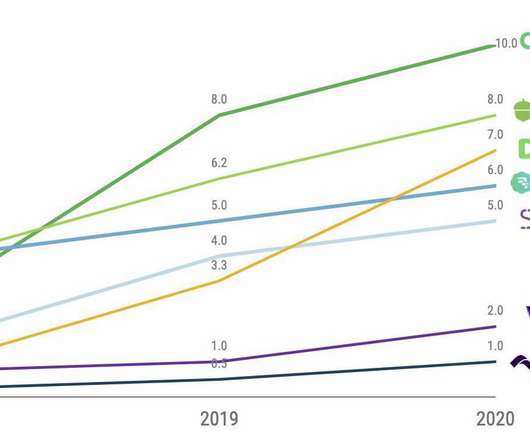

.” The report is based on findings from Q2 PrecisionLenders proprietary database of 2024 commercial lending deal flow, along with economic data from public sources, including the Federal Deposit Insurance Corporation (FDIC) and Federal Reserve.

Let's personalize your content