2024 Payment Methods Report: Overview, Insights, and Statistics

Clearly Payments

OCTOBER 31, 2024

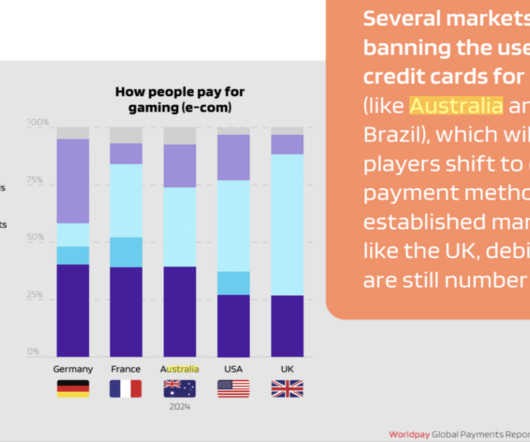

America Biometric Payments 2 Global, especially mobile-first markets Cash Payments 5 Emerging Markets, some developed regions Central Bank Digital Currencies (CBDCs) 1 Asia, Caribbean Credit Cards Overview : Credit cards allow consumers to make purchases on credit, paying later and often with interest.

Let's personalize your content