Faster Payments: Does The Fed Have A Hidden Agenda?

PYMNTS

MARCH 18, 2019

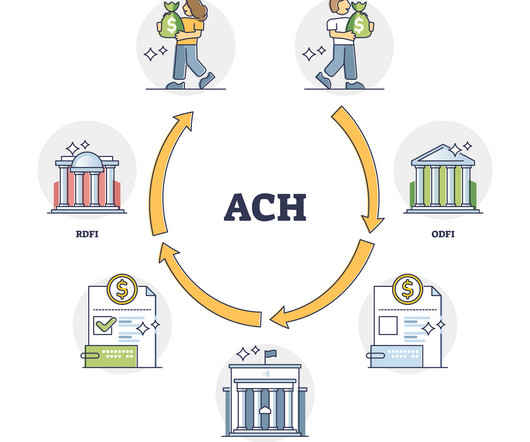

First, there was the Fed’s decision to slow faster payments progress via Same Day ACH because it wasn’t ready to approve another processing window during the day. Same Day ACH and the card rails – both of which allow for money to move fast into consumer and business bank accounts for every consumer with a debit product.

Let's personalize your content