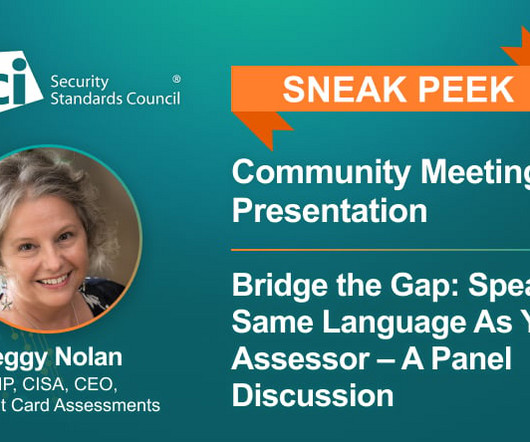

Just Published: PCI DSS v4.x Targeted Risk Analysis Guidance

PCI Security Standards

NOVEMBER 28, 2023

Risk analysis is a foundational tool to help organizations identify and prioritize potential threats and vulnerabilities within their environment. PCI DSS v4.0 introduced the concept of targeted risk analysis (TRA) with two different types of TRAs to provide entities with the flexibility to evaluate risk and determine the security impact of specific requirement controls, as appropriate for their environment.

Let's personalize your content