Podcast: Deploying AI in underwriting

Bank Automation

JANUARY 4, 2024

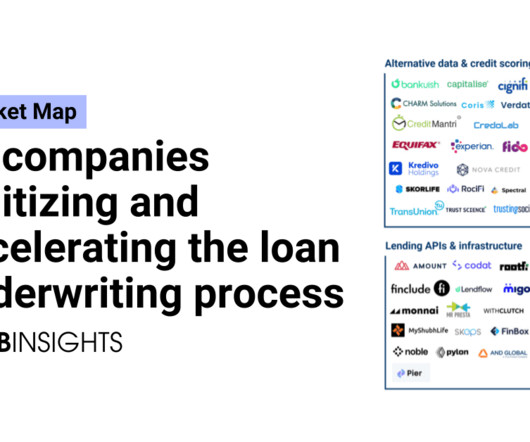

Eight in 10 credit union execs are looking to AI to enhance their underwriting capabilities. According to credit underwriting software provider Zest AI Chief Executive Mike de Vere, deploying AI can make for: Faster and more accurate decisioning; Increased community reach; and Smarter lending decisions.

Let's personalize your content