FedNow delivers new risk management tools

Payments Dive

JUNE 26, 2025

Alongside those instant payment security features, the Federal Reserve increased the maximum payment that can be sent over the real-time system to $1 million.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Federal Reserve Related Topics

Federal Reserve Related Topics

Payments Dive

JUNE 26, 2025

Alongside those instant payment security features, the Federal Reserve increased the maximum payment that can be sent over the real-time system to $1 million.

Cardfellow

JUNE 16, 2025

The minimum purchase amount must be $10 or less As I outline a little farther down, the Federal Reserve has the power to adjust the minimum purchase amount. So, although the Federal Reserve currently caps the fee at $10, it can change. The Federal Reserve set the current limit at $10 or less.

Fintech Finance

FEBRUARY 5, 2025

FIS (NYSE: FIS), a global leader in financial technology, has announced it is one of the first providers in the fintech industry certified to enable send capabilities for credit transfers in the Federal Reserves FedNow instant payment service.

Bank Automation

APRIL 3, 2025

The DOJ memo to the Federal Reserve and Office of the Comptroller of the […] The post Capital One-Discover deal waved ahead by antitrust officials appeared first on Bank Automation News. The proposed $35 billion merger between Capital One Financial Corp.

Fintech News

DECEMBER 16, 2024

To bolster confidence and transparency, Ripple will publish monthly, third-party attestations of RLUSD’s reserves. Brad Garlinghouse Early on, Ripple made a deliberate choice to launch our stablecoin under the NYDFS limited purpose trust company charter, widely regarded as the premier regulatory standard worldwide.

The Payments Association

DECEMBER 17, 2024

I am excited to join Ripples advisory board at such a pivotal moment for digital finance, said Kenneth Montgomery, former First Vice President and Chief Operating Officer at the Federal Reserve Bank of Boston.

The Fintech Times

JANUARY 31, 2025

.” The report is based on findings from Q2 PrecisionLenders proprietary database of 2024 commercial lending deal flow, along with economic data from public sources, including the Federal Deposit Insurance Corporation (FDIC) and Federal Reserve.

Trade Credit & Liquidity Management

JUNE 24, 2025

Federal Reserve. Impact on B2B Payments Being one of the owners of The Clearing House , BofA played a significant role in developing the RTP® network in consultation with peer banks, technology firms, and the U.S.

Clearly Payments

JANUARY 15, 2025

Customer Expectations In 2024, around 82% of American consumers preferred to pay by card, digital wallet , or other electronic means, according to a Federal Reserve survey. On top of that, your payment processor might add extra fees that arent always clearly explained.

Bank Automation

JANUARY 10, 2025

The Clearing House and Federal Reserve publicize the adoption of their payments rails, Real Time Payments and FedNow, by posting on their websites which financial institutions are live on their networks offering something of a roadmap for fraudsters to take advantage of newly onboarded FIs.

Payments Dive

MAY 22, 2025

Consumers keep using cash, but credit cards are king, the Federal Reserve Bank of Atlanta documented in its annual payment method survey.

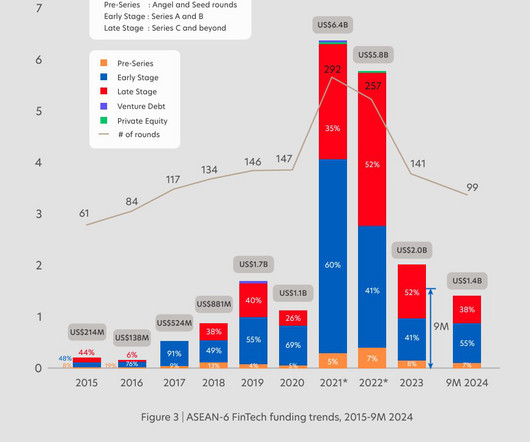

Fintech News

NOVEMBER 6, 2024

The recent interest rate cuts by the US Federal Reserve are expected to support further growth. Interest in early-stage fintechs was notable, with seed and early-stage investments representing over 60 percent of ASEAN’s funding in 2024, highlighting investor optimism for emerging fintech innovation in the region.

The Payments Association

APRIL 7, 2025

Discover membership LinkedIn Email X WhatsApp Read more Payments Intelligence The Feds crypto pivot: Unlocking banking access and its impact on payments March 18, 2025 No Comments The Federal Reserves shift on crypto banking access raises new questions for payments, stablecoins, and the role of digital assets in finance.

Fintech Finance

DECEMBER 18, 2024

Boosted Sales Potential: According to a report by Federal Reserve surveys , 74% of consumers are more likely to shop at stores that accept digital wallets like Apple Pay. Frictionless Checkout : Customers can complete payments with just a tap, ensuring a fast and smooth experience.

Fintech Finance

JUNE 10, 2025

Federal Reserve. As one of the owners of The Clearing House , Bank of America played a significant role in developing the RTP® network in consultation with peer banks, technology firms and the U.S.

Bank Automation

APRIL 25, 2025

The Federal Reserves instant payments network, FedNow, is gaining ground on The Clearing Houses Real Time Payments network and has added more FIs to its network than RTP since its launch in 2017. I think […] The post FedNow payment value grows 140% QoQ to $43B appeared first on Bank Automation News.

Bank Automation

MARCH 18, 2025

SmartBiz, a fintech providing loans to small and medium-sized businesses, has completed its acquisition of United Community Bancsharesand its subsidiary, Centrust Bank.

Finextra

JUNE 9, 2025

With the Federal Reserve proposing to make its service available 22 hours a day, seven days a week, Nacha is also considering adding a fourth processing cycle for same-day ACH. TCH went live with this change in February, enabling real-time payments up to the value of $10 million. In June, FedNow will increase its limit to $1 million.

Bank Automation

JANUARY 30, 2025

Business clients are demanding instant payment services from their financial services providers as they look to streamline payment processes.

Stax

NOVEMBER 21, 2024

A study by the Federal Reserve Bank of San Francisco showed that credit cards account for 31% of all payments, significantly more than cash at 18%, and debit cards at 29%.

Stax

MARCH 18, 2025

According to the US Federal Reserve in 2022, general-purpose card payments reached $153.3 billion transactions and $9.76 trillion in value. On top of that, 69% of Americans online in 2023 said they used digital payment methods to make a purchase. As a business owner, you just cant afford to ignore these statistics.

Finovate

FEBRUARY 20, 2025

Fedwire is a real-time electronic funds transfer system operated by the Federal Reserve Banks, enabling financial institutions to send and receive money. The deployment enables 100% straight-through processing (STP) and facilitates the bank’s compliance with upcoming ISO 20022 compliance requirements ahead of schedule.

Payments Dive

JULY 2, 2025

A few days after the senators’ announcement, the Federal Reserve Board, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency said they would seek to better address payments fraud. The agencies suggested increased collaboration, more industry education and improved supervision.

The Payments Association

APRIL 7, 2025

Discover membership LinkedIn Email X WhatsApp Read more Payments Intelligence The Feds crypto pivot: Unlocking banking access and its impact on payments March 18, 2025 No Comments The Federal Reserves shift on crypto banking access raises new questions for payments, stablecoins, and the role of digital assets in finance.

Fi911

JUNE 20, 2025

This Frankenstein approach to fraud cost US lenders an estimated $20 billion in 2020, according to the Federal Reserve. Unlike traditional identity theft where criminals steal existing identities, synthetic identity fraud involves creating new identities by combining real and fabricated information.

Bank Automation

MAY 2, 2025

The top Democrats on congressional banking committees called on the Federal Reserve to reconsider its decision to approve Capital One Financial Corp.s purchase of Discover Financial Services, saying it would inflict serious harm on consumers and the banking system.

Lending Front

MAY 27, 2025

According to the Federal Reserve Bank of Philadelphia, CRA and fair lending laws are closely intertwined. The New CRA Reality CRA exams have traditionally focused on factors like loan volume in LMI areas, community development investments, and branch availability.

Fintech Finance

MAY 27, 2025

“We built ACI Connetic to give banks a future-proof foundation to meet the ever-increasing demand for faster, smarter and secure payments,” said Scotty Perkins, head of product for banking and intermediaries at ACI Worldwide.

Fintech News

MAY 29, 2025

To support the platforms capabilities, ACI is working with major clearing and settlement bodies including the Bank of England, Pay.UK, the European Central Bank, EBA Clearing, Stet, Swift, the Federal Reserve, and The Clearing House.

Bank Automation

MARCH 31, 2025

Fintechs have been in a trough since the Federal Reserves interest rate hikes began in 2022, but analysts expect that to end as the industry gets accustomed to a different macroeconomic world.

Fintech Finance

FEBRUARY 27, 2025

Enhances Orum’s ‘Direct to Fed’ money movement solution that is built on a direct connection to the Federal Reserve’s payment rails as a service provider.

Fintech Review

APRIL 14, 2025

Federal Reserve has indicated the potential for additional interest rate increases to address persistent inflationary pressures. Meanwhile, the Reserve Bank of Australia has adopted a more measured stance, citing weakening domestic consumption and a cooling housing market as key factors influencing its policy direction.

Finextra

JUNE 30, 2025

regulators (like the OCC and Federal Reserve) increased scrutiny on banks’ use of AI, urging robust governance. Data privacy is also a concern. Banks handle sensitive customer data that cannot be simply fed into public AI models without safeguards. In 2024, U.S.

Payments Dive

JULY 17, 2025

By Caitlin Mullen • July 17, 2024 Lynne Marek/Payments Dive FedNow ‘could lower fees’ in future, analyst reports The Federal Reserve instant payments system may cut fees after it attracts more financial institutions, or in the face of competition, a Wolfe Research analyst said, citing a FedNow official.

Payments Dive

JULY 11, 2025

Deep Dive Opinion Library Events Press Releases Topics Sign up Search Sign up Search Retail Banking Restaurants Regulations & Policy Risk Technology B2B An article from Fed’s ISO ‘big bang’ hits next week The Federal Reserve’s shift of trillions of dollars in payments to the new ISO 20022 standard Monday will reverberate around the world.

Stax

APRIL 10, 2025

An ACH transfer is an electronic movement of funds from one bank account to another via the ACH (automated clearing house) network, while a wire transfer uses a secure network like SWIFT (Society for Worldwide Interbank Financial Telecommunication) or Fedwire (Federal Reserve Wire Network) to initiate the movement of funds.

Fintech Finance

JUNE 5, 2025

We are particularly excited by the recognition among central banks – including being featured on the United States Federal Reserve’s FedNow Marketplace – and global regulators that Payall’s software is a breakthrough in managing counterparty risk and compliance obligations.”

The Payments Association

APRIL 22, 2025

Read More The Feds crypto pivot: Unlocking banking access and its impact on payments March 18, 2025 No Comments The Federal Reserves shift on crypto banking access raises new questions for payments, stablecoins, and the role of digital assets in finance. Read More

Stax

JULY 7, 2025

According to Federal Reserve research , credit and debit cards make up a significant share of payments—credit cards alone account for roughly 35% of transactions As such, many merchants have sought a solution that allows them to alleviate the burden of credit card processing fees.

Bank Automation

JANUARY 9, 2025

The Clearing House Real Time Payments network grew 94% year over year on a dollar basis in 2024 as it continued to benefit from the Federal Reserves marketing of FedNow. TCH moved $246 billion on its network in 2024 and increased transaction volume by 38% YoY to 343 million transactions, according to a Jan.

Finovate

FEBRUARY 4, 2025

The Federal Reserve maintains a list of participating financial institutions on its website. In comparison, close to 60% of the financial institutions on board with FedNow are able to receive payments. As of last month, more than 1,000 financial institutions have enrolled in the FedNow Service.

Payments Dive

JUNE 17, 2025

Federal agencies took aim at payments fraud Monday, proposing more collaboration, including with states, to combat the rising problem, especially with respect to paper checks.

Clearly Payments

MAY 22, 2025

real-time payments system developed by the Federal Reserve for instant transfers between banks. -Specific Terms Durbin Amendment A U.S. law that caps debit card interchange fees for large banks and encourages routing choice for merchants. FedNow A new U.S. ACH (Automated Clearing House) The U.S.

Fintech Finance

JULY 2, 2025

“Treasury’s efforts to phase out paper checks in government payments represent a critical opportunity to modernize America’s payment infrastructure, reduce fraud and increase financial security for American taxpayers.” By the Numbers: Check fraud accounted for about 32% of all fraud losses in 2024, according to Federal Reserve data.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content