Apple unveils new iPhone touch and pay feature

Payments Dive

JUNE 12, 2024

The P2P ‘Tap to Cash’, which enables iPhone users to transfer money by holding their phones together, was unveiled along with a slate of other features Monday.

Payments Dive

JUNE 12, 2024

The P2P ‘Tap to Cash’, which enables iPhone users to transfer money by holding their phones together, was unveiled along with a slate of other features Monday.

The Payments Association

JUNE 25, 2024

Banks are de-banking payment providers, causing major disruptions in cross-border transactions and impacting financial inclusion

VISTA InfoSec

JUNE 19, 2024

With the surge in remote work and virtual meetings, video communication is crucial for businesses and individuals. However, this convenience comes with significant cyber risks that can compromise sensitive information and privacy. Therefore, this article explores the common cyber threats in video communication and provides strategies to mitigate them.

PCI Security Standards

JUNE 11, 2024

To address stakeholder feedback and questions received since PCI DSS v4.0 was published in March 2022, the PCI Security Standards Council (PCI SSC) has published a limited revision to the standard, PCI DSS v4.0.1. It includes corrections to formatting and typographical errors and clarifies the focus and intent of some of the requirements and guidance.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Payments Next

JUNE 27, 2024

By Kate Knudsen, Senior Program Director at BHMIAs the payments space changes rapidly, banks, merchants, and processors are updating front-end platforms to The post Unlocking profit potential in the payments back-office first appeared on Payments NEXT.

Finextra

JUNE 5, 2024

The Bank for International Settlements says it multi-central bank CBDC platform, Project mBrige, is ready to accept value added products and new use cases as it reaches minimum viable product stage (MVP).

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

The Fintech Times

JUNE 29, 2024

The first stage of the European Union ‘s Markets in Crypto Assets Regulation (MiCA) will come into play on 30 June. However, a new report by Acuiti , the management intelligence platform, and conducted by Eventus , the trade surveillance software provider, has found that a move to establish market surveillance systems is underway as firms find themselves underprepared.

VISTA InfoSec

JUNE 19, 2024

On June 17, 2024, the Los Angeles County Department of Public Health (DPH) disclosed a data breach impacting more than 200,000 clients, employees, and other individuals. The stolen data includes personal, medical and financial information. The DPH said the incident took place between February 19-20, 2024, was caused by a gang of cyber criminals who gained access to the log-in credentials of email accounts of 53 employees through a phishing email.

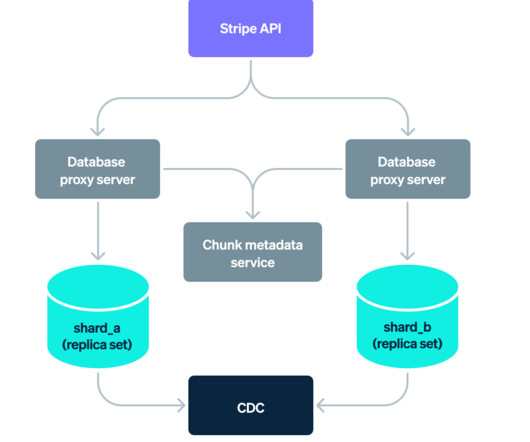

Stripe

JUNE 5, 2024

In this blog post we’ll share an overview of Stripe’s database infrastructure and discuss the design and application of the Data Movement Platform.

Bank Automation

JUNE 20, 2024

Morgan Stanley’s Jeff McMillan, head of firmwide artificial intelligence, is focused on developing and deploying AI throughout the operations of the $212 billion financial institution. The New York-based FI appointed McMillan to the newly created position March 14, he told Bank Automation News.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finextra

JUNE 11, 2024

Mastercard has set itself a target of hitting 100% e-commerce tokenisation in Europe by 2030, phasing out manual card entry and making online shopping safer and more accessible.

Payments Dive

JUNE 13, 2024

The tech giant will allow installment plans from Affirm, as well from certain debit and credit cards, onto Apple Pay alongside its own BNPL service.

Fintech News

JUNE 18, 2024

In today’s interconnected world, digital remittance in Asia and the movement of money across borders have become essential aspects of global finance. Billions of dollars traverse the globe every second, with a significant portion of these transactions originating from individuals, particularly migrant workers sending funds to their loved ones in their native countries.

The Fintech Times

JUNE 2, 2024

Fraud prevention decision-makers across Europe are well aware of the growth and danger of AI-driven identity and financial fraud, but are unprepared to combat it, Signicat , the European digital identity and fraud prevention solution provider, has revealed in a new report. ‘ The Battle against AI-driven Identity Fraud ‘ study by Signicat delves into how organisations across Europe are battling the growing threat of AI-driven identity fraud.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Fintech Finance

JUNE 19, 2024

New research released today by emerchantpay , a leading global payment service provider and acquirer, has found that there is strong market potential for merchants who prioritise the adoption of Open Banking payments early in their payment strategies. The survey of UK consumers found that one in two people are unknowingly using this payment method during checkout, with more than half (51%) of the UK population being unfamiliar with the term Open Banking.

Bank Automation

JUNE 25, 2024

Point-of-sale financing as an alternative payment method is a growing opportunity for lenders, technology company Pagaya’s President Sanjiv Das says on this episode of “The Buzz” podcast. According to auto lender and Pagaya partner Ally Financial, POS financing is expected to reach a value of more than $81 billion by 2030.

Finextra

JUNE 28, 2024

Thousands of Barclays, HSBC, Nationwide and Virgin Money customers have been hit by a payments problem that has seen some people not receiving their salaries.

Payments Dive

JUNE 11, 2024

Consumers remained committed to cash use last year, even as the share of card payments rose and online payments increased, according to an annual Federal Reserve study.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Fintech News

JUNE 17, 2024

The global wealth management industry is undergoing a profound transformation, including in Asia, driven by the convergence of technological advancements like artificial intelligence (AI), shifting investor preferences, and evolving economic conditions. Capgemini’s World Wealth Report 2024, now in its 28th edition, reveals that high-net-worth individuals (HNWI) are reaching unprecedented numbers and wealth levels, with the Asia Pacific region emerging as a hotbed of growth and innovation.

The Fintech Times

JUNE 1, 2024

Fraudsters continue to pose huge issues for the financial sector across the globe. UK Finance recently revealed that criminals stole over £1billion in 2023 alone. Even worse, the fraud landscape shows no signs of improving, as bad actors increasingly utilise AI to increase the damage done to financial organisations. However, many of the largest financial organisations worldwide are actively investigating measures to counteract these threats.

Finovate

JUNE 3, 2024

PayPal’s stablecoin, PayPal USD (PYUSD), was officially added to the Solana Blockchain last week. This shift comes after the California-based company launched on Ethereum blockchain last summer. Now, PayPal stablecoin users can send PYUSD on Ethereum or Solana when transferring out to external wallets. “For more than 25 years, PayPal has been at the forefront of digital commerce, revolutionizing commerce by providing a trusted experience between consumers and merchants around the wor

Bank Automation

JUNE 12, 2024

ING is running a generative AI-driven chatbot pilot in the Netherlands before it plans to scale the technology. The pilot funnels only 2.5% of clients’ chats into its gen-AI chatbot, Chief Analytics Officer Bahadir Yilmaz told Bank Automation News at the recent Money2020 Europe event in Amsterdam.

Speaker: David Nisbet, Everett Zufelt, and Michaela Weber

Once upon a time, in the vast realm of online commerce, there lived a humble checkout button overlooked by many. Yet, within its humble click lay the power to transform a mere visitor into a loyal customer. 🧐 💡 Getting checkout right can mark the difference between a successful sale and an abandoned cart, yet many businesses fail to make payments a part of their commerce strategy even when it has a direct impact on revenue.

Finextra

JUNE 18, 2024

Bank-to-bank payment messaging network Swift is working to facilitate interoperability of Verifcation of Payee schemes across Europe as new research shows that 83% of SMEs across France, Germany, Italy and Spain rank upfront beneficiary checks as important to them in trading across borders.

Payments Dive

JUNE 7, 2024

The state may become the first in the nation to outlaw the imposition of credit and debit card interchange fees on state excise tax and tips.

Fintech News

JUNE 11, 2024

Daranee Saeju, Assistant Governor of Payment System Supervision and Financial Service User Protection at the Bank of Thailand (BoT) , announced the launch of a new initiative to test programmable payment systems under the Enhanced Regulatory Sandbox framework. This initiative responds to the rapid and complex development of financial innovations, such as distributed ledger technology (DLT) and smart contracts, which are transforming financial services.

The Fintech Times

JUNE 17, 2024

According to research from fraud prevention platform Ravelin , the UK economy and businesses that reside within it are at great risk, as the UK’s online fraud presence has increased the most out of 10 countries surveyed in the past 12 months. In its fourth edition of the Fraud and Payments Survey Ravelin has revealed that 84 per cent of UK merchants have confirmed an increase in online fraud.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Fintech Review

JUNE 4, 2024

By Nikolay Seleznev , Chief Strategy and Business Development Officer at Uzum The descendants of those who traded on the Silk Road are now embracing a new vehicle for commerce: fintech. For years unable to access innovative finance and technology products, Uzbeks are making up for lost time. In a country and a region which is enjoying robust growth and undertaking a program of economic modernisation, the market for Uzum – and other digital service ecosystems – is growing at an exponential rate.

Bank Automation

JUNE 17, 2024

Banco Bilbao Vizcaya Argentaria SA is planning to open a digital consumer bank in Germany, using existing technology to expand at relatively low cost. The project is led by Javier Lipuzcoa, the head of BBVA’s digital bank in Italy, according to people familiar with the matter.

Finextra

JUNE 26, 2024

Days after claiming that it had hacked the US Federal Reserve, the Russia-linked LockBit ransomware gang has posted stolen customer data from Evolve Bank & Trust on the dark web.

Payments Dive

JUNE 24, 2024

The persistence of the networks’ ‘honor all cards’ rule may be a key reason Judge Margo Brodie is unlikely to approve a negotiated resolution of the two-decade-old case brought by merchants.

Advertisement

In the fast-moving manufacturing sector, delivering mission-critical data insights to empower your end users or customers can be a challenge. Traditional BI tools can be cumbersome and difficult to integrate - but it doesn't have to be this way. Logi Symphony offers a powerful and user-friendly solution, allowing you to seamlessly embed self-service analytics, generative AI, data visualization, and pixel-perfect reporting directly into your applications.

Let's personalize your content