What is ACH Credit and ACH Debit and How Do They Work?

Stax

NOVEMBER 13, 2024

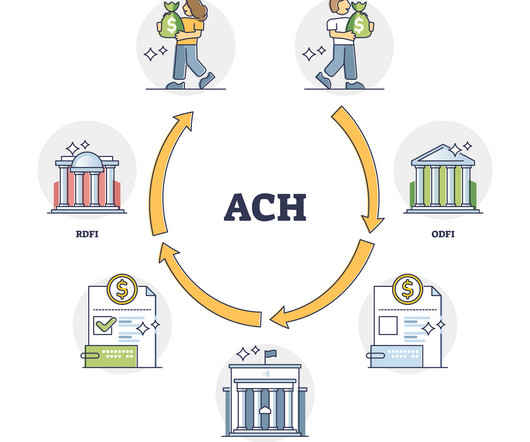

It’s like a direct deposit from one account to another, but unlike wire transfers, they are not subject to a fee by the processing banks. Many businesses prefer ACH credit payments for paying suppliers or vendors, especially when the amounts vary or when the payments are made irregularly. Health insurance and premiums.

Let's personalize your content