European Central Bank sets out business model for digital euro

NFCW

JUNE 25, 2024

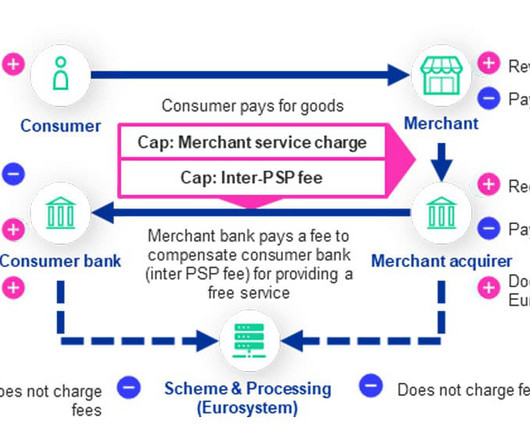

TRANSACTION FEE: A step-by-step overview of the digital euro compensation model Payment service providers will be able to charge merchants a fee for enabling them to accept digital euro transactions, the European Central Bank (ECB) has revealed, but a cap will be placed on the amount that it will be possible for them to charge.

Let's personalize your content