Evolving money laundering risks for EMIs: Insights from the upcoming NRA

The Payments Association

JULY 19, 2025

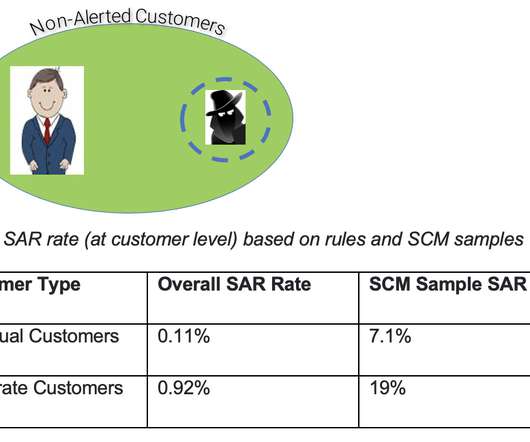

Evolving money laundering risks for EMIs: Insights from the upcoming NRA 18 July 2025 by Payments Intelligence LinkedIn Email X WhatsApp What is this article about? The UK 2025 National Risk Assessment’s decision to reclassify e-money institutions (EMIs) as high risk for money laundering and terrorist financing.

Let's personalize your content