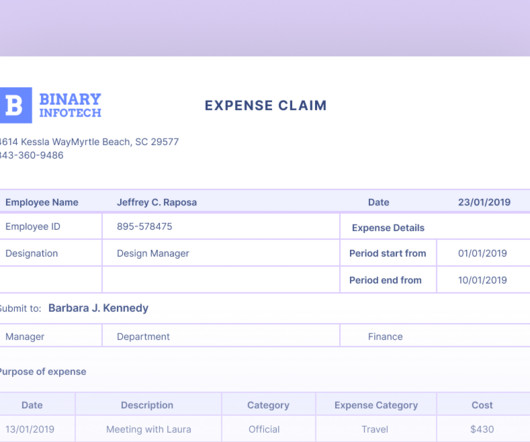

45 Business Expense Categories for Businesses and Startups

Nanonets

MARCH 4, 2024

Business expense categories are a systematic classification of costs incurred during the operation of a business, designed to organize and track financial outflows for purposes such as tax preparation, budgeting, and financial analysis. Calculated based on IRS guidelines. Deductible within IRS guidelines.

Let's personalize your content