AI Meets AML: How Smart Analytics Fight Money Laundering

FICO

FEBRUARY 13, 2017

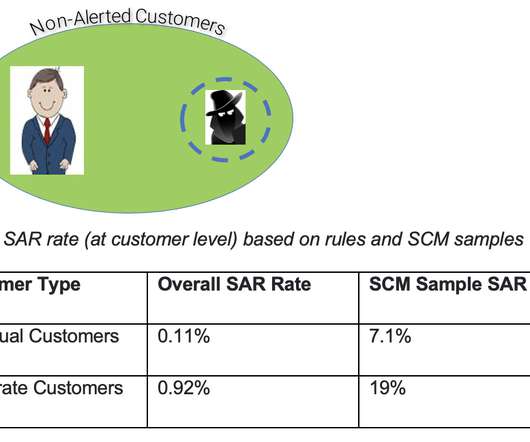

One of the places where AI can make a huge difference today is in anti-money laundering (AML). As regulations become ever more demanding, the rules-based systems grow more and more complex with hundreds of rules driving know your customer (KYC) activity and Suspicious Activity Report (SAR) filing.

Let's personalize your content