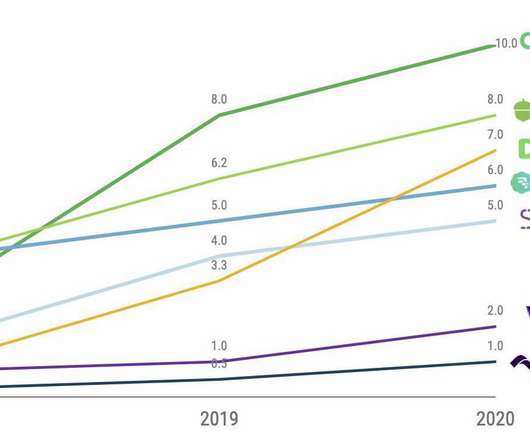

Where Challenger Banks & Incumbents See The Next Digital Banking Opportunity

CB Insights

JANUARY 5, 2021

Between 2008 and 2018, the number of commercial bank branches in the US has declined by more than 6%. High banking fees, overdraft penalties, and a lack of requisite minimum deposits have pushed these households away from the formal banking system. Source: FDIC. First name. Company Name. Phone number.

Let's personalize your content