What Is an ACH API and How Does It Work?

Stax

JUNE 23, 2025

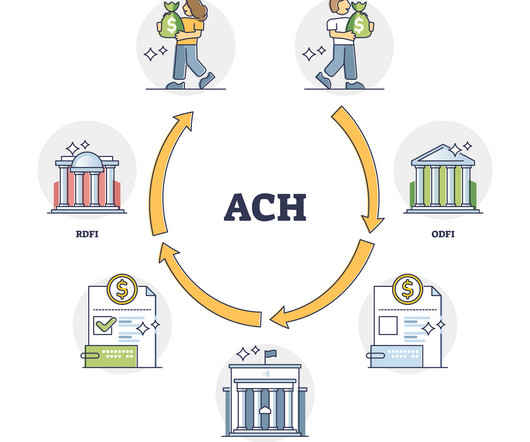

If you take a lot of ACH payments, then leveraging an ACH API can streamline your processes and ensure you’re able to take payments in an efficient and secure manner. In this article, we will look at the role of ACH API, how it works, and how you can implement it for your company. What is an ACH API?

Let's personalize your content