Alternative Payment Methods Every Online Business Should Consider

My Payment Savvy

AUGUST 10, 2025

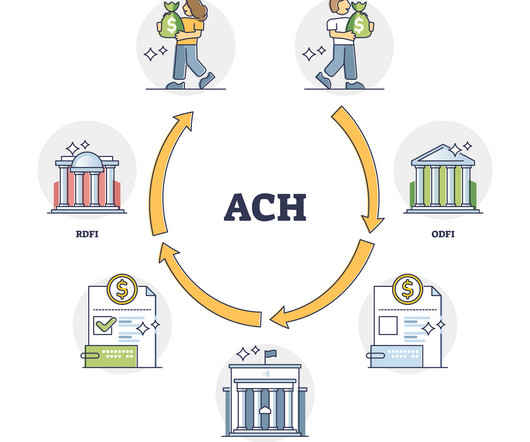

B2B transactions, subscription services, healthcare payments , and collections operations love ACH for good reason. The ACH network processes over 29 billion transactions annually, so you’re dealing with proven infrastructure, not some experimental system. If you’re doing volume, those savings add up fast.

Let's personalize your content