What is ACH Credit and ACH Debit and How Do They Work?

Stax

NOVEMBER 13, 2024

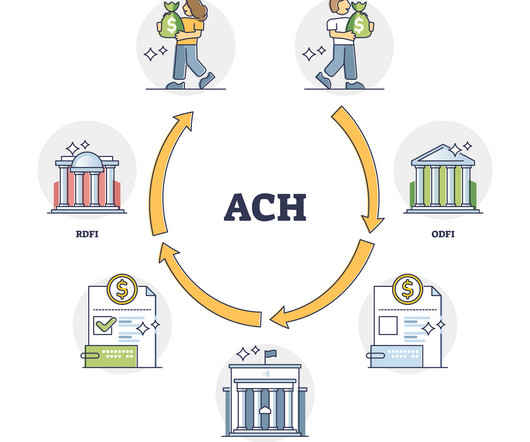

ACH credit payments are best for sending one-time payments whereas ACH debit payments are more suited for making regular payments, such as for monthly utility bills. All ACH payments are secure and reliable, available 24 hours a day, 7 days a week, and 365 days a year. What are ACH Debit Payments?

Let's personalize your content