Why FedNow Will Slow Real-Time Payments

PYMNTS

AUGUST 12, 2019

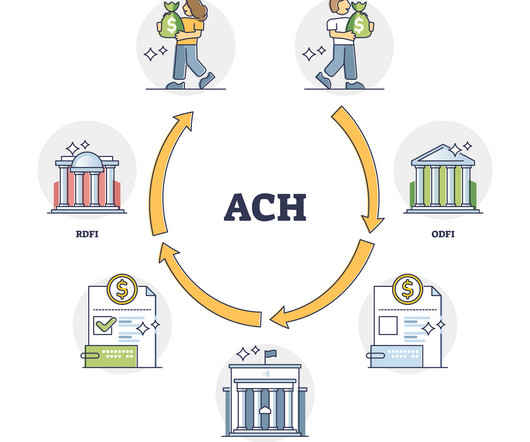

It’s also not why the Fed decided to enter the real-time payments fray. The Real-Time Payday Reality. Direct deposit over the ACH network eliminated that friction and got them earlier access to those funds. But a handful of the 12,000 FIs and 51 percent of deposits does not a real-time payments network make.

Let's personalize your content