What is an ACH Deposit and How Does It Work?

Stax

APRIL 23, 2024

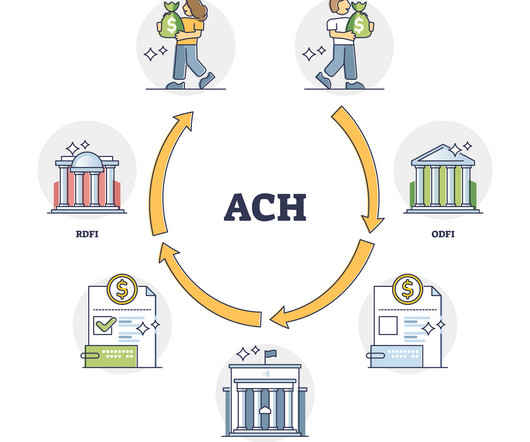

Many small businesses choose ACH operators because they are more convenient than most direct deposits. ACH transfers don’t come with high fees and transactions and they’re easily edited if an employer wants to adjust payroll, extend bonuses, or reimburse an employee.

Let's personalize your content