Wallet wars: How digital payments are reshaping finance

The Payments Association

MARCH 19, 2025

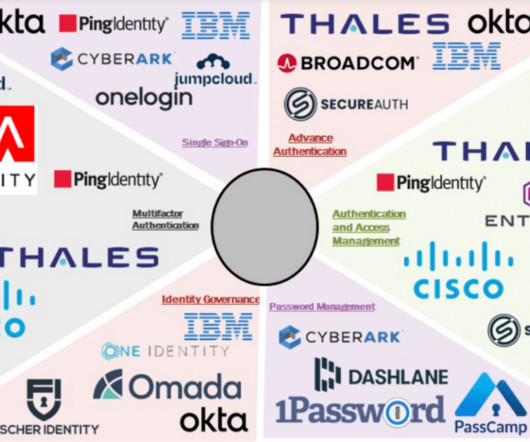

The rapid adoption of digital wallets has introduced a complex web of regulatory considerations, ranging from data privacy and cybersecurity to anti-money laundering (AML) compliance and cross-border transaction governance. Adopt multi-factor authentication (MFA) and biometric verification to reduce fraud risks.

Let's personalize your content