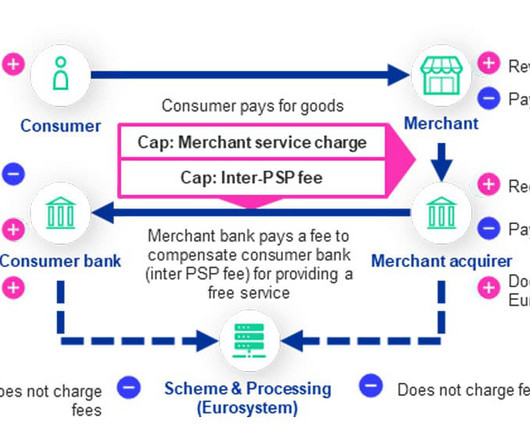

European Central Bank sets out business model for digital euro

NFCW

JUNE 25, 2024

. “When paying offline, personal transaction details would only be known to the payer and the payee and would not be shared with payment service providers, the Eurosystem or any providers of supporting services.

Let's personalize your content