Reflecting on 2024: A transformative year in payments regulation

The Payments Association

DECEMBER 2, 2024

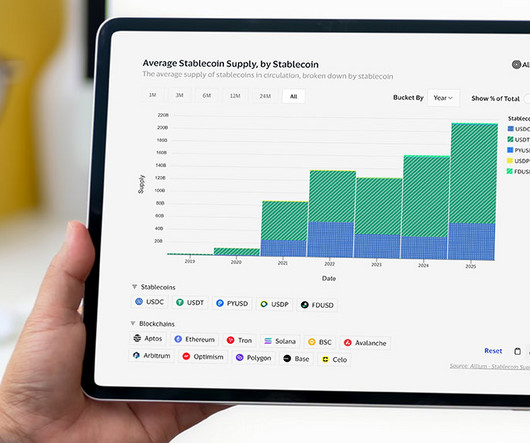

MiCA aims to establish a comprehensive and harmonised framework for crypto-assets across EU member states, enhancing investor protection and ensuring financial stability while fostering innovation within the crypto sector. In response to MiCA’s requirements, several crypto exchanges and service providers adjusted their offerings.

Let's personalize your content