Evolving money laundering risks for EMIs: Insights from the upcoming NRA

The Payments Association

JULY 19, 2025

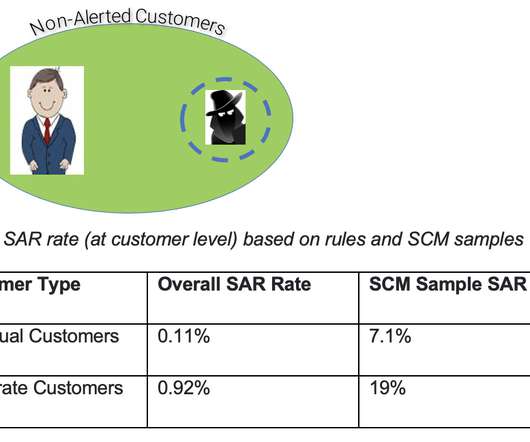

This reclassification has significant regulatory and commercial consequences for the EMI sector, potentially raising compliance costs, impacting bank partnerships, and limiting innovation. The expected knock-on effect is soaring compliance costs and a decrease in inward investment attractiveness, which will decrease due to this rating shift.

Let's personalize your content