Expense Reconciliation: Step-by-Step Guide

Nanonets

MAY 7, 2024

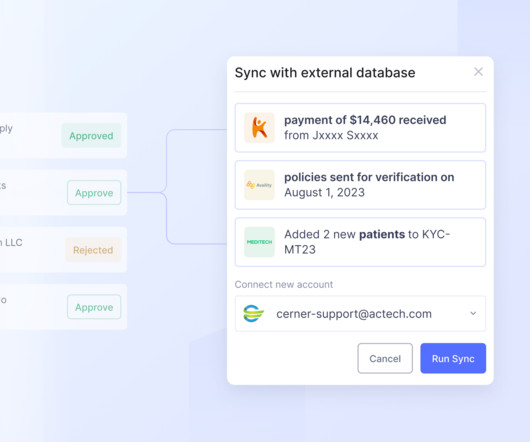

By comparing these records, businesses can identify any discrepancies, such as missing or duplicate transactions, incorrect or false amounts, or any unauthorised expenses and transactions. Credit card reconciliation helps identify discrepancies such as fraudulent transactions, duplicate charges, or unauthorised expenses.

Let's personalize your content