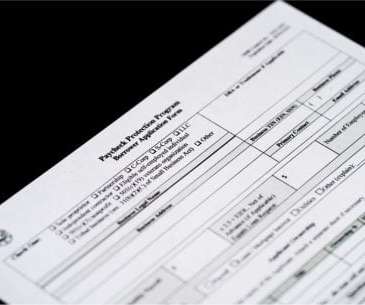

Mnuchin Now Says All PPP Loan Recipients Will Face Audits

PYMNTS

APRIL 29, 2020

One of the things that will be required is you will have to show a payroll report that you actually spent the money on payroll and other items that qualify for forgiveness,” he said. Borrowers must certify 75 percent of the money was spent on payroll. The SBA didn’t respond to requests for comment, the WSJ reported.

Let's personalize your content