Money mules create a real-time AML problem: Here’s how to address it

The Payments Association

APRIL 23, 2025

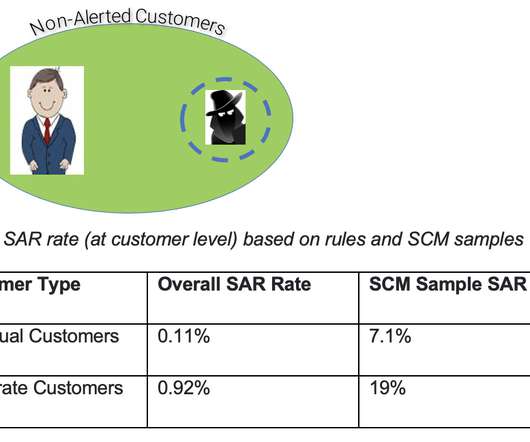

It takes AML teams weeks (if not months) of diligent analysis to escalate these activities to law enforcement. Additional outgoing transfers are stopped, and a Suspicious Activity Report (SAR) is filed within the regulatory deadline. Network analytics identify connections to other mule accounts.

Let's personalize your content