AI Meets AML: How the Analytics Work

FICO

FEBRUARY 15, 2017

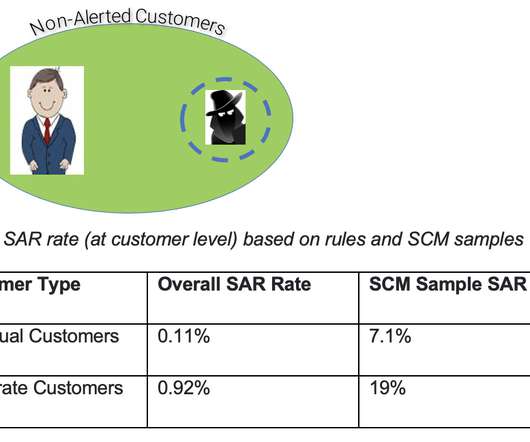

We have built on top of the FICO TONBELLER solutions using FICO’s battle-proven and patented artificial intelligence and machine-learning algorithms, which are used in FICO Falcon Fraud Manager to protect about two-thirds of the world’s payment card transactions. The weights of the model are either expert-driven or based on limited SAR data.

Let's personalize your content