The 90 Day Road to Successful CFO

The Finance Weekly

APRIL 12, 2022

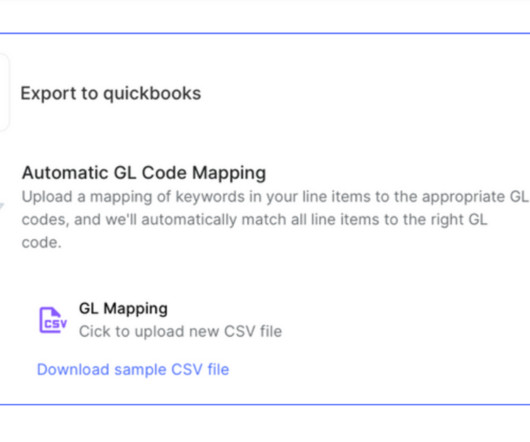

Assess the output of the Finance Function Within a finance function you have two distinct divisions, accounting and FP&A. Ask yourself the following questions to put your new finance function to the test and optimize it: What is the quality of your closing process? What is the reporting process like?

Let's personalize your content