Project Guardian: Interoperability From Tokenised Bank Liabilities Could Save Firms $50bn in FX Fees

The Fintech Times

JULY 4, 2025

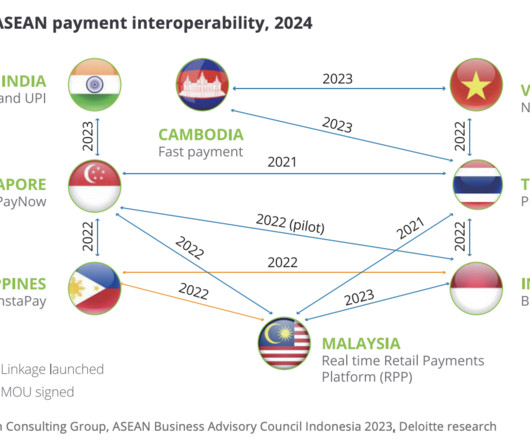

With firms spending roughly $120billion (S$154.2billion) on cross-border transaction fees, alternatives are being sought after. According to a new report from the Project Guardian FX industry group, implementing tokenised bank liabilities and shared ledgers in cross-border payments and FX is a viable solution.

Let's personalize your content