The Ultimate Guide to Salesforce Payments

EBizCharge

APRIL 22, 2025

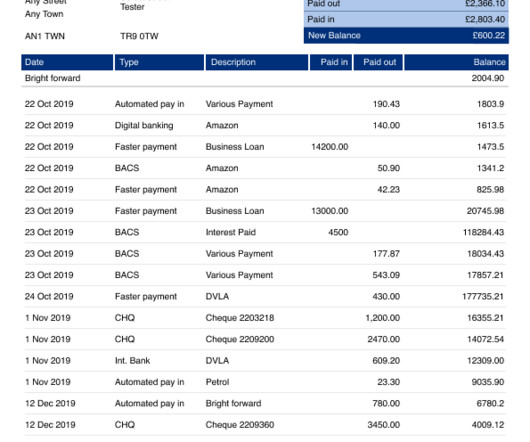

Secure payment data and access management Businesses should implement strong data encryption protocols to protect sensitive information both in transit and at rest. Routine payment reconciliation Regular reconciliation ensures that the data in Salesforce matches whats recorded in your payment gateway and accounting systems.

Let's personalize your content