The platform risk paradox: Managing digital commerce fraud at scale

The Payments Association

JUNE 11, 2025

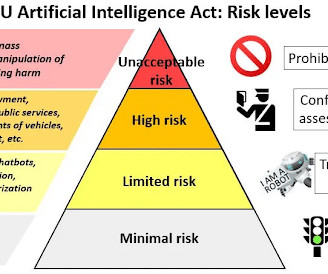

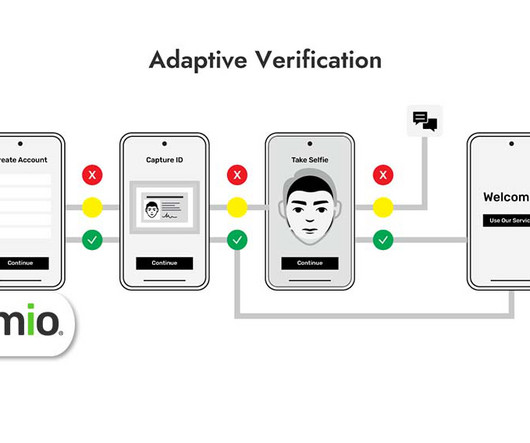

AI-driven scams leverage sophisticated attacks from phishing emails to deepfake videos and voice impersonations. Integration with multiple data providers enhances fraud analysis across UK market conditions, creating comprehensive risk assessment capabilities that scale with platform growth.

Let's personalize your content