What is Reconciliation in Payments

Clearly Payments

APRIL 17, 2025

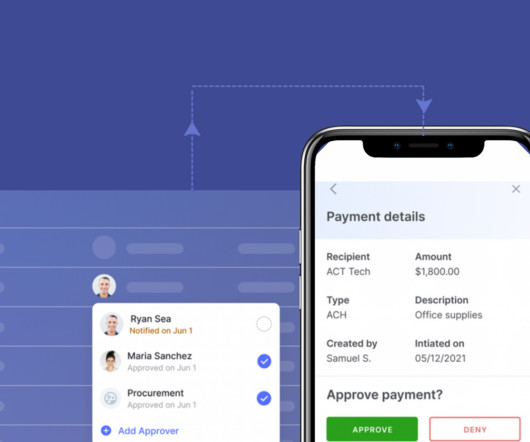

How Does Payment Reconciliation Work? The payment reconciliation process usually involves a few key steps: 1. Common reasons include: Payment processing fees Refunds or chargebacks Timing differences (i.e., Bank Reconciliation This compares a companys internal payment records with its bank statement.

Let's personalize your content