The GENIUS Act Passes: 4 Things This Means for Banks and Fintechs

Finovate

JUNE 18, 2025

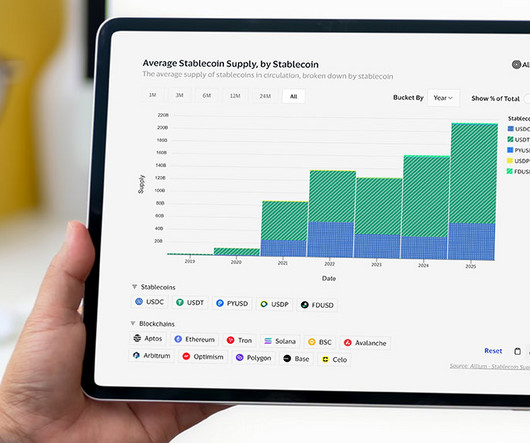

That’s because it is not only the first stablecoin legislation to gain real bipartisan traction, but it will also serve as a foundation for the US to begin a digital asset ecosystem. Because of this, many traditional financial institutions in the US have shied away from associating themselves with stablecoins.

Let's personalize your content