5 Top Payment Trends Impacting Asia in 2024

Fintech News

JANUARY 30, 2024

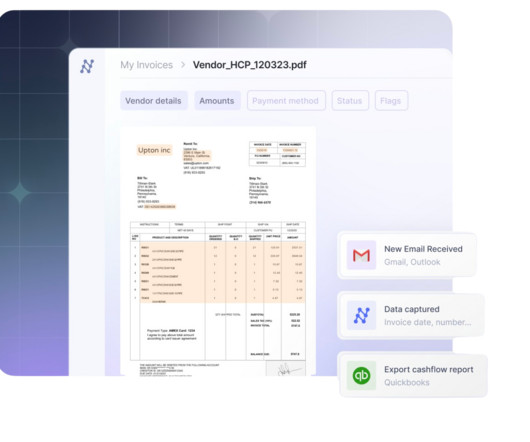

AI-powered processes have streamlined labour-intensive tasks, minimised errors, and sped up transactions. One of the key functions of AI in this domain is its ability to match incoming payments with outstanding invoices, thereby automating payment reconciliation and significantly reducing manual efforts.

Let's personalize your content