Understanding Payment Processing Costs in Acumatica and How You Can Save

EBizCharge

MARCH 11, 2025

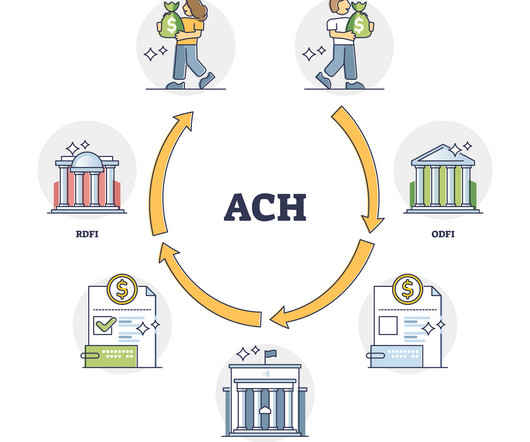

ACH processing fees: ACH processing fees are the costs associated with transferring funds electronically through the ACH network. These fees are typically lower than credit card processing fees and are charged by payment processors or banks for facilitating direct bank-to-bank transfers.

Let's personalize your content