Vietnam’s Digital Finance Landscape: Banks Gain Ground Amidst Shifting Competition

Fintech News

JULY 3, 2024

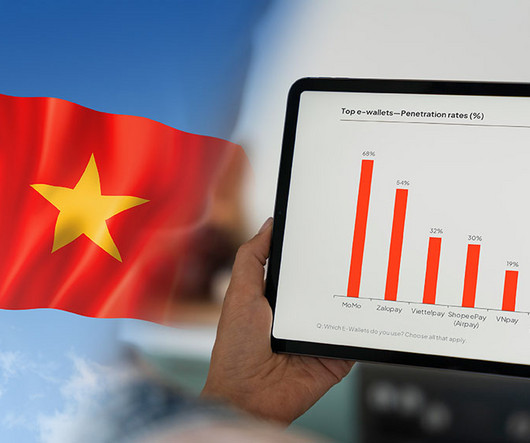

These incumbents had made a strong entry, collectively achieving a 23% penetration rate and securing the fifth position, the data show. The Vietnam Bank for Agriculture and Rural Development (Agribank), for instance, deployed in 2022 Agribank Digital, a set of digital tools and devices designed to increase financial access in rural areas.

Let's personalize your content