How a Payment Consultant Helps Enterprises Optimize Payments Infrastructure, Operations, & Costs

Clearly Payments

APRIL 8, 2025

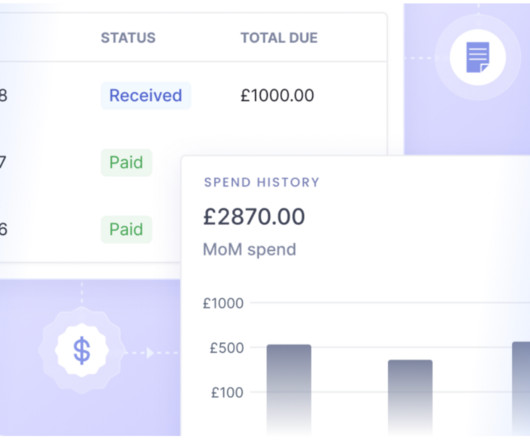

Clearly Payments acts as a long-term advisor, helping with: RFPs and vendor selection for new platforms or partners M&A payments due diligence New product launches and billing models (subscriptions, usage-based, etc.)

Let's personalize your content