APAC Sees 23% Decline in Crypto Fraud

Fintech News

MARCH 24, 2025

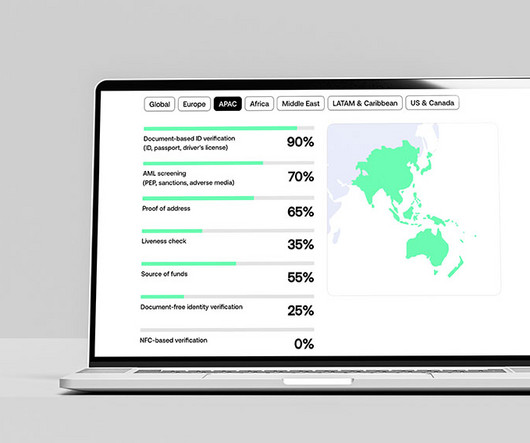

In Singapore, the central bank strengthened in 2024 the Payment Services Act (PSA), introducing more stringent requirements for crypto service providers relating to AML/CFT, user protection and financial stability on service providers. Asia is a global leader in crypto adoption. million out of 560 million crypto owners worldwide.

Let's personalize your content