FinCEN Files Show Banks’ ‘Whack-a-Mole’ Battle Against KYC/AML

PYMNTS

SEPTEMBER 21, 2020

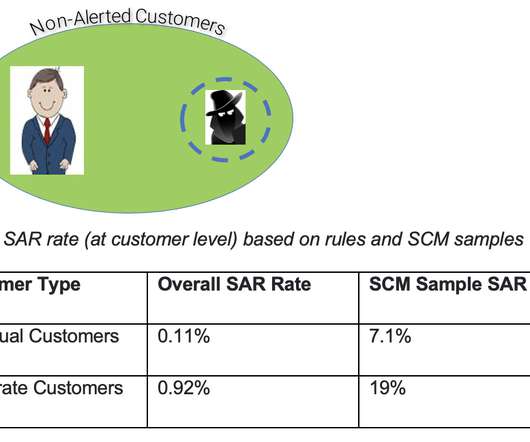

The documents, officially known as suspicious activity reports (SARs for short) show that the banks had filed more than 2,000 reports across the past 17 years. And in PYMNTS’ own coverage, the twin external forces of regulatory scrutiny and market pressures are pushing FIs to retool and strengthen their anti-money laundering (AML) efforts.

Let's personalize your content