The Ultimate Guide to Salesforce Payments

EBizCharge

APRIL 22, 2025

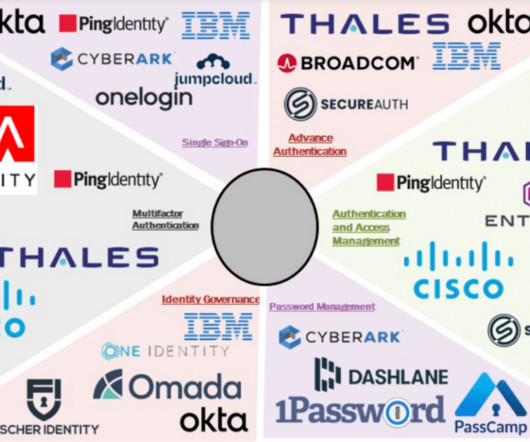

Most providers require that you set up a merchant account, which acts as a secure intermediary to transfer funds from customer payments to your business bank account. Secure payment data and access management Businesses should implement strong data encryption protocols to protect sensitive information both in transit and at rest.

Let's personalize your content