Overcoming Accounting Problems: Your Friendly Guide

Nanonets

SEPTEMBER 21, 2023

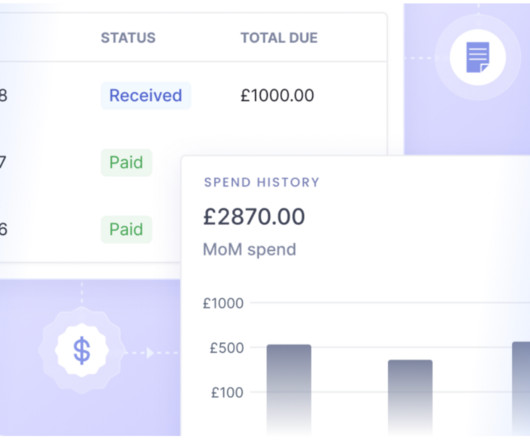

By implementing the right strategies and utilizing modern technologies, businesses can overcome these accounting hurdles and ensure a smoother financial flow. These errors can have a significant impact on financial statements, leading to incorrect financial analysis and decision-making.

Let's personalize your content