What is Reconciliation in Payments

Clearly Payments

APRIL 17, 2025

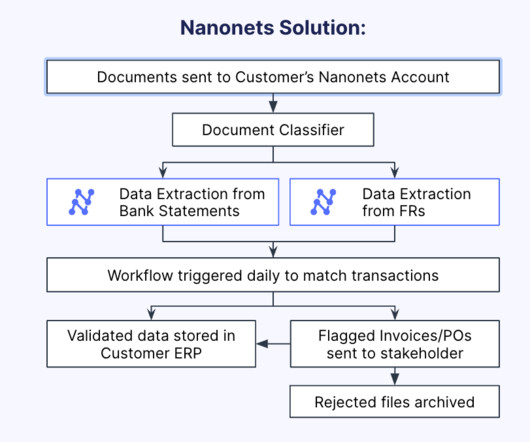

Compliance and Auditing Regulatory bodies often require accurate financial reporting. Reconciliation helps companies prepare for audits and meet compliance obligations. How Does Payment Reconciliation Work? The payment reconciliation process usually involves a few key steps: 1.

Let's personalize your content