Payment Reconciliation: Process, Challenges, and How to Automate It

Basis Theory

MARCH 27, 2025

Learn what payment reconciliation means to different industries, and how automation can make life easier for finance teams. Start reconciling better!

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Basis Theory

MARCH 27, 2025

Learn what payment reconciliation means to different industries, and how automation can make life easier for finance teams. Start reconciling better!

Fintech Finance

FEBRUARY 14, 2025

Ageras , a leading fintech platform for accounting, admin and banking software for small businesses in Europe, has completed the full acquisition of Storebuddy ; an integration software specialised in automating accounting processes for online stores.

Trade Credit & Liquidity Management

MAY 29, 2025

Automation and artificial intelligence (AI) are transforming accounts receivable (AR) and B2B trade credit management by replacing manual, error-prone processes with intelligent, AI-driven tools. Credit decision-making, collections, cash application, deductions, and communications are greatly enhanced by AI-powered AR automation.

Fintech Finance

NOVEMBER 13, 2024

Traditionally, brands have lacked the payment infrastructure that enables retailers to settle invoices via methods other than bank transfer – which can be expensive, slow and lead to late payments. Through payment links, retailers can settle their invoices in a faster, more convenient and more secure way compared to bank transfer.

EBizCharge

FEBRUARY 26, 2025

NetSuite offers a comprehensive suite of financial services designed to streamline payment processes. Whether youre a seasoned user or a newcomer, this guide will equip you with the knowledge you need to harness the full potential of NetSuite payments. Compatibility is key for smooth payment workflows.

Payments Source

APRIL 8, 2020

For decades, automated check reconciliation stood out as the lone sanctuary for AR professionals. However, the advent of payment automation indicates that electronic payment reconciliation is more than capable of taking up the baton, says Nvoicepay's Kim Lockett.

Fintech Finance

FEBRUARY 17, 2025

The post Yonder Partners With Griffin to Launch Top-Ups and Simplify Payments Reconciliation appeared first on FF News | Fintech Finance. With these additions, Yonder is able to give its customers more control over how they spend credit while still enjoying all the rewards.

The Payments Association

MARCH 19, 2025

As the world shifts to faster, more efficient digital payment methods, the question remains: Are your payment systems ready? The growing role of digital assets in payments The way we process payments has changed drastically in the last decade. Transactions are now settled in minutes instead of days. The result?

Clearly Payments

APRIL 17, 2025

In payments and finance, one of the most important activities that businesses perform is reconciliation. While it may sound like a complex term, reconciliation is simply the process of making sure that two sets of financial records match. What is Reconciliation? At its core, reconciliation is a comparison process.

The Payments Association

FEBRUARY 10, 2025

Payment Service Providers must strengthen due diligence, monitoring, and collaboration with regulators to address these risks. Virtual IBANs (vIBANs) have become a key component of modern payment systems, enhancing payment reconciliation and facilitating cross-border transactions.

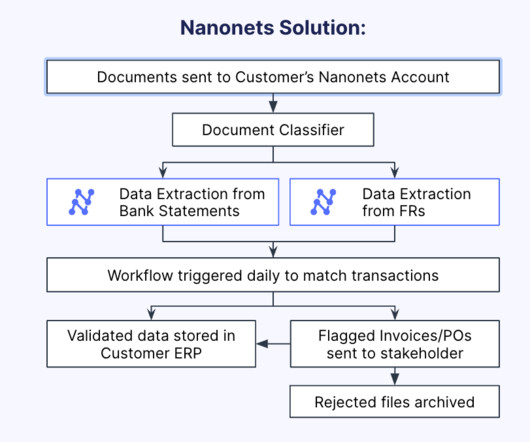

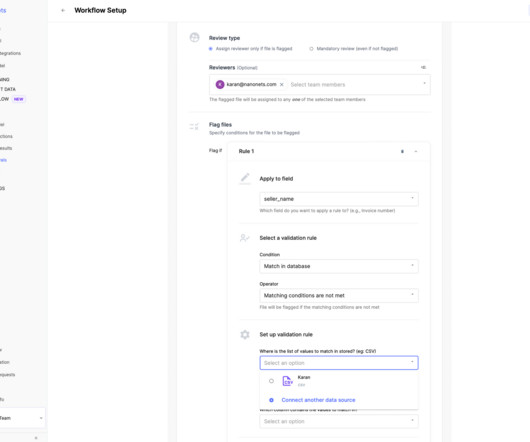

Nanonets

APRIL 24, 2024

Introduction Accuracy and efficiency are non-negotiable in the processing of payments in any company, be they payments received by the company for products/services rendered, or made to vendors for products/services received. Payment reconciliation is the process of verifying all payment transactions.

Clearly Payments

JANUARY 21, 2025

The shift from traditional payment methods to modern digital solutions is no longer optional; it is essential for delivering public services effectively and meeting citizen expectations. Limited Payment Options: Many government platforms still lack support for modern payment methods like mobile wallets, credit cards, and digital banking.

The Fintech Times

NOVEMBER 15, 2024

Blink Payment , a UK paytech platform offering digital payment solutions to businesses, plans to enter B2B fashion payments through integration with Zedonk , an Enterprise Resource Planning (ERP) software provider, to help over 1,000 fashion brands and showrooms streamline their payment processes.

Nanonets

JUNE 21, 2023

As transactions flow in and out, reconciling payments becomes crucial to ensure accuracy, identify discrepancies, and maintain a clear financial picture. Manual payment reconciliation processes can be time-consuming, error-prone, and inefficient. What is payment reconciliation?

Fintech Finance

FEBRUARY 4, 2025

At the forefront of transforming the South African School payments landscape, Sticitt is enabling schools to increase revenue generated from parents and the wider community while automating payment reconciliations and reporting.

Nanonets

AUGUST 16, 2024

But insurance claim automation is paving the way for faster, more accurate, and more customer-friendly experiences. The drive to enhance claims processing through new technologies has intensified, especially since every dollar saved directly impacts profitability. What is claims process automation?

Paystand

SEPTEMBER 19, 2024

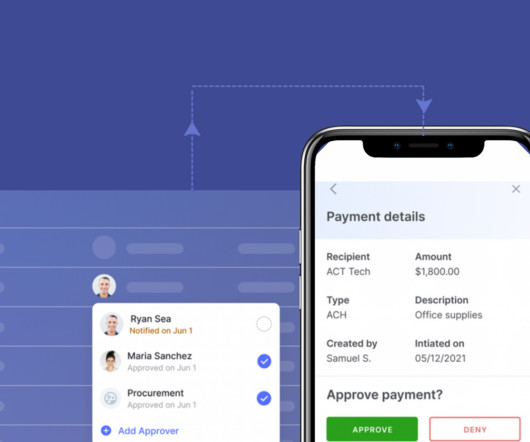

Table of Contents What is payment reconciliation? How does payment reconciliation work? Why is payment reconciliation important? What are the three types of payment reconciliation? How can automation improve payment reconciliation?

Trade Credit & Liquidity Management

MAY 29, 2025

From a Press Release dated March 25, 2025, London, England Chaser , a global accounts receivable automation solution provider, has announced a new integration with Odoo , a popular business management software platform. This automation supports faster and more accurate accounts receivable workflows.

PYMNTS

JULY 12, 2019

Order-to-cash solutions provider Billtrust has added Priority Commercial Payments to its Business Payments Network (BPN) to streamline B2B payments reconciliation, the companies said in a press release this week.

EBizCharge

MARCH 7, 2025

Acumaticas electronic payment processing is a game-changer for businesses looking to enhance their sales and receivables processes. Integrating a payment gateway into Acumaticas system further streamlines online transactions, allowing businesses to accept payments securely and efficiently. What is Acumatica?

Nanonets

MAY 8, 2023

Reconciliation is a mandatory process for businesses of all sizes. Reconciliation helps businesses gain insight into business spending and their categories in real-time. Account reconciliation takes a lot of time and effort. Also, the manual reconciliation method is error-prone. How do reconciliation manually?

EBizCharge

APRIL 22, 2025

Since the ways merchants handle transactions can make or break their success, integrating a reliable and robust payment processing system that syncs with their other business systems can be invaluable. Seamless payment processing software can also be synced directly inside of it when partnered with the right payment gateway.

Nanonets

JANUARY 10, 2024

Remember the time when a single misplaced receipt could derail the entire expense reporting process in a company? We’ll take you through the knotty challenges of traditional expense approval processes and unfold how embracing efficiency can be a game-changer for your financial management. Well, those days are long gone.

Fintech Review

MAY 4, 2025

Treasury Prime Provides direct bank relationships combined with a flexible API platform for deposits, payments, and ledger services. Treezor Enables card issuance, bank accounts, payment processing, and lending via a unified API layer. Best for : High-volume subscription businesses seeking to minimise failed payments.

Nanonets

FEBRUARY 1, 2024

In the rapidly evolving business landscape, the efficiency of Accounts Payable (AP) processes is no longer just a back-office concern but a strategic imperative. Accounts Payable (AP) automation is the use of technology to streamline and improve the process of managing a company's bills and payments owed to others.

Fintech Finance

JUNE 3, 2025

One Inc , the leading digital payments network for the insurance industry, today announced the launch of its advanced 835 Electronic Remittance Advice (ERA) solution, fully integrated into the ClaimsPay ® platform. healthcare system, driven by fewer errors, faster processing times, and streamlined administrative tasks.

PYMNTS

FEBRUARY 11, 2020

The feature enables businesses to send multiple payment requests at the same time while also triggering automated reminders to streamline the process and save time. We’ve digitized the manual reconciliation process and eliminated the need for expensive, paper-based [checks].

Nanonets

APRIL 6, 2023

In today's globalized economy, supply chains are becoming increasingly complex, with numerous stakeholders, processes, and data points involved. This is where supply chain automation comes into play, offering a range of benefits, from increased efficiency and productivity to reduced costs and errors.

Nanonets

FEBRUARY 21, 2024

Yet, the leap from traditional bookkeeping to a streamlined, automated financial ecosystem is one that many QuickBooks users are yet to fully embrace. Inefficient Approval Workflows : Traditional processes often involve cumbersome approval chains that delay payments and complicate cash flow management. in real time.

Nanonets

MARCH 21, 2023

Using purchase orders can help businesses to better manage their purchasing process, avoid misunderstandings or disputes with vendors, and ensure that they receive the goods or services they need to operate effectively. Once a purchase order is issued and accepted by the seller, it becomes a binding contract between the two parties.

Fintech Finance

SEPTEMBER 18, 2024

For Brex Embedded partners, their customers can make fast, secure global payments in virtually any currency, all while automating their existing financial workflows and payment reconciliation. Brex’s robust credit process and balance sheet makes onboarding faster.”

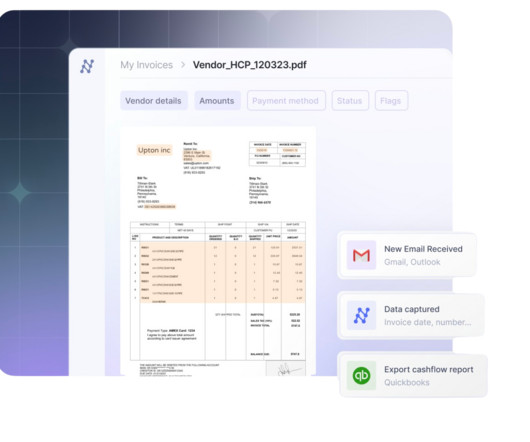

Nanonets

APRIL 16, 2023

Source: esker The introduction of intelligent automation into the accounts payable process minimizes the risk of manual intervention, accelerates operations, and helps maintain compliance. So, what exactly is AP automation ? Looking for an AI based AP Automation solution? How Does AP Automation Work?

Nanonets

JULY 14, 2024

IInvoice management software is transforming financial processes for businesses in 2024. Many businesses face challenges with invoice processing —from data entry errors to delayed payments. Modern invoice management tools automate much of the process. These issues can impact cash flow and overall efficiency.

Fintech News

JANUARY 30, 2024

Decentralised finance , which utilises blockchain technology, employs open-source technology to reduce costly payment processing fees by minimising the need for intermediaries. The Role of AI in Payment Services The introduction of artificial intelligence (AI) in the payments sector has brought a plethora of benefits.

Nanonets

AUGUST 31, 2023

Contact center automation tools can enable your team to swiftly tackle mundane tasks that often consume their time. This is where contact center automation comes into play. By automating repetitive tasks, your team can concentrate more on problem-solving and enhancing customer experience. What is contact center automation?

The Fintech Times

AUGUST 24, 2024

For a long time, the retail and hospitality sectors have faced the ‘last mile’ data problem in cash credit card payment reconciliation. Some merchants struggled with balancing cash and credit card payments against their point-of-sale platform.

Nanonets

FEBRUARY 26, 2024

Finance teams are well aware of the tedious and error-prone nature of manual accounts payable processes. This could also lead to late payments or in some cases potential vendor fraud. Today, you can automate these processes using accounts payable automation solutions and optimise accounts payable for your finance teams.

Fintech Finance

SEPTEMBER 18, 2024

Born out of a need to solve the cash flow problem many businesses experienced during COVID-19, Slope provides short-term financing and simple payment options for the B2B sector. Recognizing the need for robust, reliable payment infrastructure, Slope selected Checkout.com as its strategic partner.

Nanonets

AUGUST 21, 2023

B2B payment automation involves everything from the automation of capturing and processing invoices to making payments to vendors and reconciling those payments in your books. What if you could reduce these costs by 80% and increase the speed of processing invoices by up to 10 times?

EBizCharge

JUNE 6, 2024

One ERP that stands out is Microsoft Dynamics 365, a powerhouse for managing business operations, including the pivotal task of credit card processing. Microsoft Dynamics 365 is a comprehensive suite of cloud-based business applications that help organizations manage and automate their customer relationships, operations, financials, and more.

PYMNTS

OCTOBER 17, 2017

Together, the companies will enable streamlined payment reconciliation, facilitated by automated virtual card (v-card) payments in a solution built for financial institutions and their corporate clients. And that’s good news for card issuers, too, which could see greater net-new card payment volume.

Nanonets

APRIL 30, 2023

Looking to automate payroll processes? Try Nanonets and automate employee onboarding, reimbursements, payment, and approvals with no-code workflow s. Looking to automate your manual payroll processes? Book a 20-min live demo to see how Nanonets can help your team implement end-to-end payroll automation.

Stax

JULY 9, 2024

Digital payments feature a multitude of benefits including: Digital payments streamline transactions by eliminating the need for physical handling of cash or checks. Transactions can be initiated and completed in seconds, reducing the time spent on payment processing.

Nanonets

MAY 8, 2023

Bookkeeping is the process of keeping financial records for your business. Automate general ledger entries, GL coding, invoice management , and more. Book a personalized live demo to see how you can save time, effort, and costs while automating your bookkeeping processes. What is bookkeeping?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content